Wealthy people donate almost €8000 to charities

Dutch people with a disposable income of at least €500,000 give an average of €7,915 per year to charities. Research conducted by ABN AMRO MeesPierson and Maastricht University found that wealthy people in paid employment donated the most (€12,992 on average), followed by entrepreneurs (€10,349). Those with inherited wealth gave by far the least (€2,802). As a percentage of their capital, wealthy employees also donated the most (0.5%) and heirs the least (0.1%).

Marianne Verhaar-Strijbos, director of Philanthropy Advisory Services at ABN AMRO MeesPierson: ‘Among all the wealthy people who are philanthropically active, a change is visible: they give less money than they did a few years ago and they are increasingly choosing social investments or loans. This is a good trend because it promotes entrepreneurship on the part of the recipient and reduces dependence on the giver. Private initiatives are also making a comeback because many donors want to see the impact of their donations. All these changes make it necessary for charities to change how they work. If they want to attract and retain the support of the donor, it is important to establish connections and strike the right chord with them. Asking for extra donations is counterproductive in any case.’

The entrepreneurial donor

Dr Paul Smeets, researcher and Assistant Professor of Finance at Maastricht University: ‘Philanthropy is often traditionally associated with giving by heirs, but our research shows that entrepreneurs and employers are the primary active donors. They see their gifts as investments and are actively involved in charities. For example, they may sit on the board of a philanthropic institution. Although heirs do indeed give less to charity, they are most definitely committed to society. They express that commitment through sustainable and impact investments, for example. An impact investment not only aims for financial returns, but also for social returns.’

Individual donations are the most popular

A large majority of wealthy people (85%) give to charity in the form of individual donations. In addition, almost half of them give in the form of recurring donations that are fixed for at least five years. Establishing a recurring donation makes it possible to deduct the value of the gift from taxes. Four out of ten wealthy people use the charitable giving tax deduction. If this deduction were to be partly or entirely abolished, 40% of these people would lower their donations.

Art and culture could suffer

Employees use the charitable giving tax deduction less often than heirs and entrepreneurs. However, employees would also be more likely to reduce their donations if the charitable giving tax deduction disappeared. Wealthy people who donate a lot to nature and the environment, animal welfare, and art and culture would donate less if the charitable giving tax deduction were abolished. Donations to art and culture are currently eligible for additional tax benefits, which would make them more vulnerable to the elimination of tax deductions. The charitable giving tax deduction is currently under discussion in the Netherlands and it is still unclear what will happen to it. That is why researchers have studied the possible impacts of changes on donations from wealthy people.

Also read

-

Capillary damage can lead to depression

The Maastricht Study specialises in conducting microcirculation measurements

-

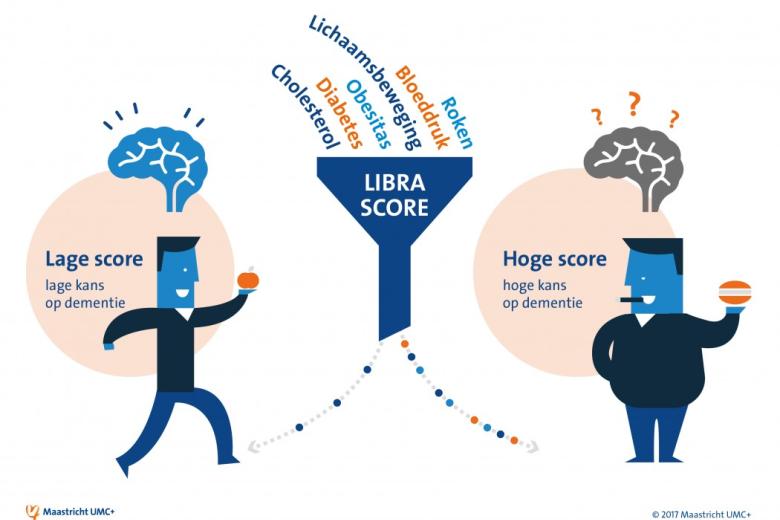

Individual risk profile could help prevent dementia

Prevention of dementia potentially stimulated by drawing up personal risk profile (MUMC+ news).

-

New plastic fixation cable for scoliosis surgery

Less invasive operation, maximum vertebral growth, and no stray metal particles (MUMC+ news).