Why do Dutch entrepreneurs just across the border not receive corona benefits?

During the corona crisis, national measures in the three countries on the Limburg borders are not coordinated equally well. As a result, there is currently a situation in the border region where certain border entrepreneurs fall between the cracks, such as in the Dutch newspaper NRC on April 2nd ("Emergency support for entrepreneurs? Not for these 'border cases") and recently on April 24th in the Limburger and WijLimburg ("It seems as if the border entrepreneur stinks of rotten fish"): a Belgian resident with a year-old fish shop in the Netherlands, who now misses out on support facilities. Given the complexity of the measures, some nuance is needed. Some measures have already been fine-tuned, others have not yet been fine-tuned and that is why The Netherlands in particular needs to take action. Moreover, the lack of regulation for cross-border entrepreneurs is not in line with the strategy of a cross-border economy.

Although the authorities of Belgium, Germany and the Netherlands have each defined their own policies, the objectives and form of the aid measures are quite similar. For example, national measures can be broken down into five different objectives:

- One-off compensation payments for the loss of income caused by the Corona measures;

- Payments to provide entrepreneurs with a minimum income now that turnover is falling or disappearing;

- Reduction of personnel costs through a simplified application for a reduction in working hours or an allowance for wage costs;

- Postponement of payment of taxes and social security;

- Simplified and advantageous loans, for the purpose of absorbing the business assets.

‘Bijstand’ based scheme does not cross borders

It is mainly the income support measures (second category) that are not well coordinated across borders, with their cause in Dutch income support: the Temporary bridging scheme for self-employed persons (Tozo). The Tozo is modelled on the existing bijstand for the Self-employed and provides (1) income support for living expenses and (2) a loan for working capital. The Tozo is linked to the place of residence and nationality of the entrepreneur and the location of the business.

The fact that the Netherlands did not take cross-border entrepreneurs into account is evident from the initial draft of the Tozo: entrepreneurs who do not live in the Netherlands are not entitled to the Dutch Tozo, while tax and social security contributions have been paid in the Netherlands. "In order to prevent the self-employed from ending up falling between two stools” in border situations, it has been laid down by ministerial regulation by the State Secretary for Social Affairs and Employment, Van Ark, that self-employed persons who live in the Netherlands and are active outside the Netherlands are entitled to maintenance assistance, i.e. the monthly benefit. Self-employed persons who live outside the Netherlands but are active in the Netherlands (such as the Belgian with the Dutch fish shop) are only entitled to the assistance for working capital, or the loan. This is much less helpful than an income supplement.

Belgium and Germany do it differently

State Secretary Van Ark hereby states that he complies with the country of residence principle. This means: the country in which you live provides income support. However, Belgium and Germany have a different perspective: they apply the country of employment principle. Both countries grant more or less facilities if their state treasury is also co-payed through social security contributions or taxes.

As a result, there is a clear "gap" in income support for border entrepreneurs active in the Netherlands due to the Tozo. After all, there is no entitlement to it in the country of residence, nor in the country of employment (the Netherlands), as the Dutch news outlet NOS recently reported.

Neighbouring countries do not consult sufficiently

We therefore see a cross-border bottleneck in income support measures in particular. This reveals a general problem: the coordination of national rules between neighbouring countries is not optimal. As a result, among other things, borders have had to be closed, the finger has been pointed at each other and border entrepreneurs are thus left out.

Cross-border economy is being undermined

This is surprising because the neighbouring countries have built up a lot of cross-border coordination structures together in recent years. Particularly with North Rhine-Westphalia and Flanders, the Netherlands has tried at various levels to remove barriers to a cross-border economy. Active efforts have been made to stimulate doing business across the border. Such discoordination and national thinking undermine cross-border economic activity.

Alignment with where taxes are paid

This is why we advocate coordination during a crisis. Pay attention to the policy of your neighbouring countries when formulating national policy. If neighbouring countries follow where social security contributions and taxes are paid, follow that too. This avoids gaps in the cross-border economy. This also ties in with the financial and emotional reality: entrepreneurs can make use of the social schemes in the country in which they have always contributed and paid. It is therefore a logical reasoning to link up with the social contributions paid by the cross-border entrepreneur and thus protect the cross-border economy.

By: The Institute for Transnational and Euroregional cross-border cooperation and Mobility (ITEM) in Maastricht & Grensinfopunt

-

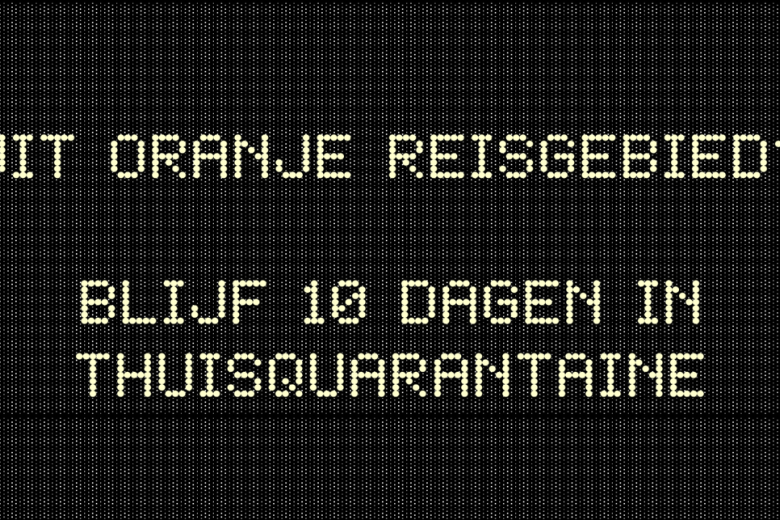

Quarantine exception insufficient for border region

Continued disproportionate impact on daily life in the border region

With the circulation of the Coronavirus, governments are trying to restrict the movement of people. Staying at home and limiting unnecessary travel and visits is a frequently used and successful recipe against the flare-ups of...

-

Three countries, three ways of counting?

Comparing figures on corona infections and mortality can be misleading

The number of people dying in Belgium from the effects of the Coronavirus (COVID-19) is higher than in neighbouring countries. This high mortality rate makes it seem as if Belgium is not doing as well as its neighbours. The...

-

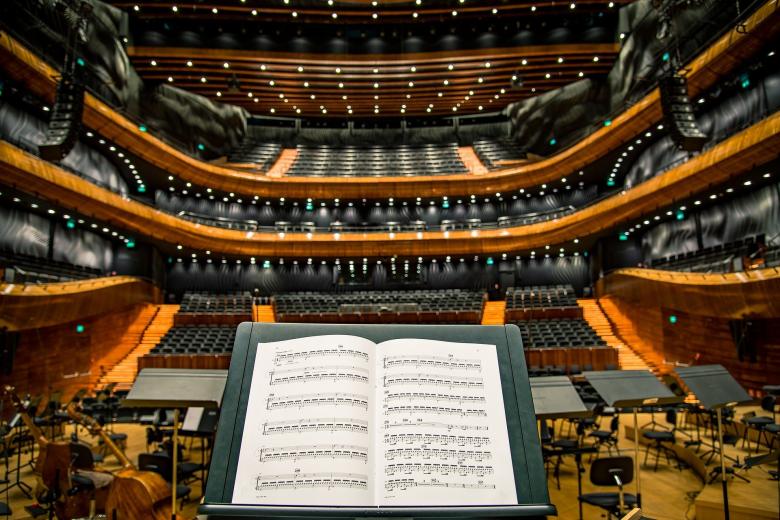

Corona-creativity-boost or corona-energy-drain?

Creativity needed more than ever in the creative industry

The Corona-crisis and the lockdown hits severely, and particularly the cultural and creative industries. Already a traditionally precarious industry not having deep pockets, COVID‑19 knocks out most core activities of the sector. Concerts...