SBE academics react to 2022 Nobel Prize in Economic Sciences

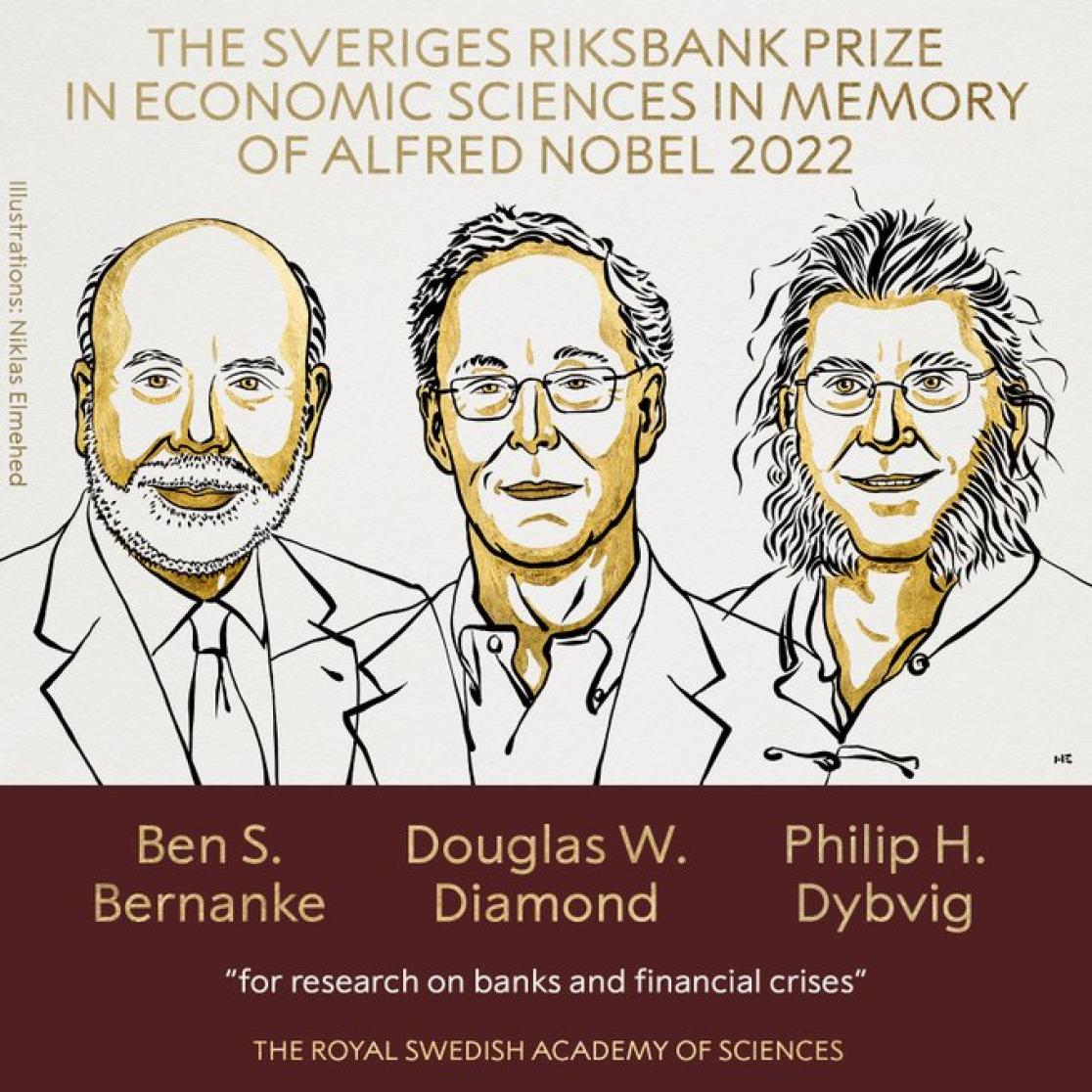

On 10 October, The Royal Swedish Academy of Sciences decided to award the 2022 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel to Ben Bernanke, Douglas Diamond and Philip Dybvig for research on banks and financial crises.

In this article, SBE's experts share their thoughts on the 2022 Nobel Prize in Economic Sciences.

Jaap Bos - Theory and empirics are mutually reinforcing

Professor of Banking and Finance, Chair of the Finance Department at SBE

Bernanke definitely deserves credit for his empirical work, but the work by Diamond and Dybvig has been much more ground breaking, in my opinion. It is an excellent example of what great theory does: it provides an elegant, intuitive explanation for something that, for a long time, seemed so very counterintuitive. In this case, the “it” is a bank run, where all of us, sometimes literally, run to the bank to get our money out for fear of losing it. Thanks to Diamond and Dybvig, we understand the features of a standard deposit contract much better, we know the impact of deposit insurance and we see why the health of an individual bank is tied in with the health of the whole system. That is indeed quite a lot to get out of a paper!

However, I disagree a bit with the Nobel Prize committee. In their brief comments, they emphasize that we have the winners to thank for explaining why we cannot let banks fail. That is not what their contribution was, in my opinion. In fact, I do not think it was what they were aiming for in the first place. Rather, the laureates' works help us design financial regulation and supervisory institutions that lower the need to save banks, by preventing bank runs.

Although, as said, I am particularly happy that Diamond and Dybvig won the Nobel for this topic, that does not mean that I think including Bernanke was a bad idea. One reason is his contributions to our empirical understanding of the links between monetary policy and the banking system. Another reason, one that is perhaps more important to me, is that the Nobel Prize committee has once again recognized that theory and empirics are mutually reinforcing. That is something worth remembering for our staff, students, and society as a whole."

Diogo Sampaio Lima - Their work has an immense societal impact

Assistant Professor of Economics

Bernanke’s work taught us that banking crises are not a natural consequence of the decline in economic activity; instead, the banking sector contributes decisively to enhance and prolong the economic downturn. Diamond and Dybvig’s work provided a theoretical complement to Bernanke’s empirical findings. It is a unified body of work providing insights into the valuable role of banks in daily economic activity and economic growth. But also into how they make the economy more vulnerable to financial crises.

Diamond and Dybvig (1983) is an elegant and clear display of the role of banks, their inherent vulnerabilities, and the role of public institutions in fixing these vulnerabilities. Banks are financial intermediaries that channel funds from depositors to finance investment projects, playing a key role in the allocation of capital and economic growth. The inherent source of banks' vulnerability is maturity mismatch: depositors want to access their accounts at will (liquid assets) and bank loans are tied to long-term investment projects. This opens the possibility of bank runs. If for some reason, most depositors decide to withdraw funds from their accounts - a bank run - a wealthy bank can go bankrupt. If confidence in the banking system is lost, there is a contagion effect affecting all remaining banks as we have witnessed during the great depression and, to some extent, during the great recession of 2007-2009.

In short, their contributions allow us to better understand not only the great depression of the 1930s but also the 2007-2009 global financial crisis. Their work has an immense societal impact as it has enriched our understanding of the role of banks as a key source of financial vulnerability and equipped our policymakers with tools to deal with these challenges."

Lenard Lieb - Recent research in this field would not be possible without this years' laureates

Assistant Professor at the department of Macro, International & Labour Economics

"Banks frequently receive negative attention in the media and have been directly blamed for the Great Financial Crisis. But we should not forget that banks serve the important role of intermediating between cash-rich and cash-poor economic agents. What this year’s Nobel Laureates have highlighted, in particular Diamond and Dybvig, is that providing what bank customers need (direct access to one’s current account, long-term loans) can, when unrestricted, unregulated and without a backstop, come at a very high cost.

The additional link between bank runs and the drying up of credit flows has been analysed by Bernanke. The ideas of this year’s Nobel Laureates have clearly influenced many policy decisions that central banks have taken during the Great Recession. We’ve come a long way since then, in particular with the introduction of minimum liquidity requirements and the expansion of deposit insurance schemes. All these measures dampened the impact of the Great Recession and made it less severe than the Great Depression (of the 1930s)

The research area of “banks and financial crises” will, I am sure, yield more Nobel winners. The prize and recognition for this year’s laureates are certainly well deserved. I just wonder what other major yet newer ideas in this field should be awarded the recognition they deserve. Will the next financial crisis be ignited by banks hiding their risky business where financial regulation cannot reach? Or is it coming from the non-bank sector? These are topics of more recent research. This research is likely to be equally impactful for future policy design, yet would not have been possible without the foundation laid out by this year’s laureates."

Also read

-

Riding the waves of change: From a summer vacation to a life that feels as good as it looks

For SBE alumna Victoria Gonsior, one spontaneous decision: trying surfing sparked a journey of self-discovery, leading her to redefine success, embrace joy, and build a career that aligns deeply with her values. From quiet beaches in Sierra Leone to coaching sessions rooted in purpose, Victoria...

-

SBE researchers involved in NWO research on the role of the pension sector in the sustainability transition

SBE professors Lisa Brüggen and Rob Bauer are part of a national, NWO-funded initiative exploring how Dutch pension funds can accelerate the transition to a sustainable society. The €750,000 project aims to align pension investments with participants’ sustainability preferences and practical legal...

-

Maastricht University recognised among top institutions in CEO Magazine’s 2025 Green MBA Rankings

We are proud to share that Maastricht University School of Business and Economics has been recognised as a top-ranked institution in the CEO Magazine 2025 Green MBA Rankings.