The digital market competition with multisided markets: a case of Indian e-commerce

Digital platforms are one of the key developments in facilitating industry 4.0 and are at the center of the multifold benefits the consumers derived through this. An important feature of the digital platforms is the presence of high sunk costs and low marginal costs (UNCTAD, 2019). This occurs since the major cost of operation is the platform creation and popularizing it among the stakeholders. Algorithms is the key tool through which the major decisions and processing undertaken by these platforms. This involves high investment in the initial stage of operation. Apart from this, successful operation of any platform depends on the efficient marketing and the service delivery to make it popular among customers. Prevalence of high sunk cost and network effects makes high entry barriers to the new players to successfully enter into the market.

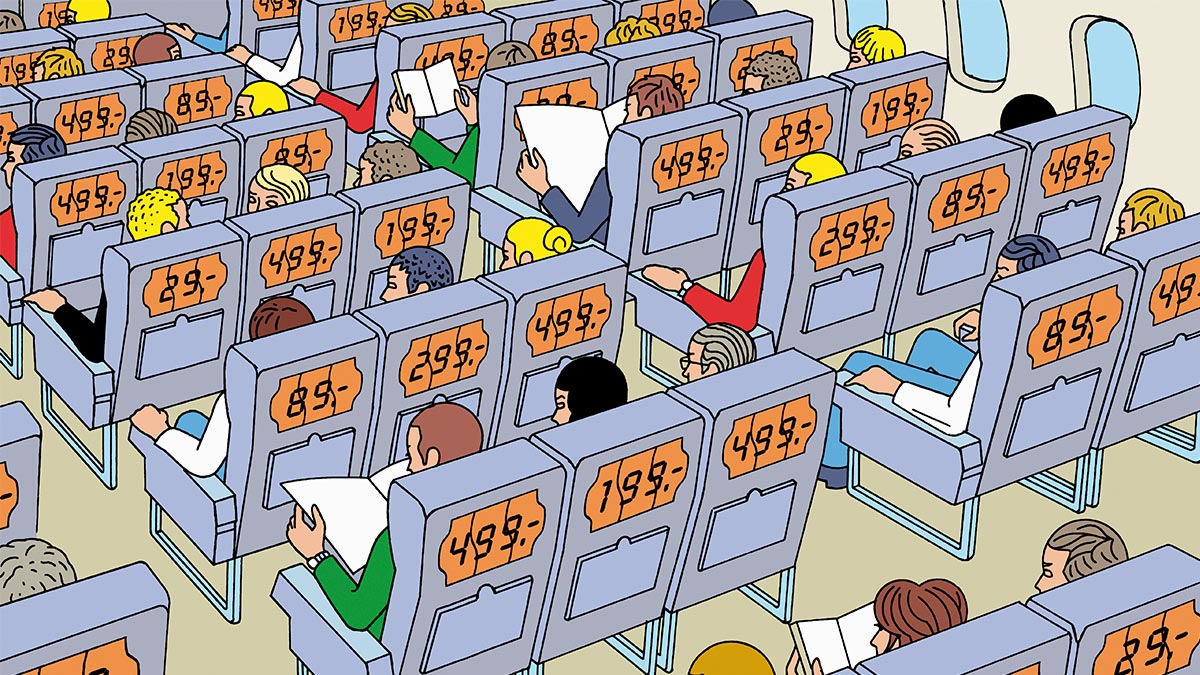

Competition assessment in traditional markets is based on the consumer welfare approach, which consider lower prices or increased quality of products at the same price as an indicator of increased competition. However, online markets are multisided, thereby the income generation is also through multiple channels. Pricing decisions are not only based on the traditional demand supply determination as the revenue generated through selling the product is only factor, which is linked to the registered seller of the product. The platform generates revenue from multiple sources such as various marketplace commissions, marketing support, advertisement and so on. Companies with high network effects generates more revenue from these channels. Multiple revenue sources enable the platforms to offer lower prices and also provide various offers and discounts, which further increases their sales, and revenue generation through other channels. Here, the customer satisfaction must be much higher than the traditional mode of purchase due to the well-known convenience effects of online platforms in the context of modern lifestyles. Nevertheless, the offline sellers of the same products may not be able to provide additional offers and discounts due to the absence of multisided markets. This creates competition concerns since the level playing field is disrupted. Further, with the huge sunk cost and network effects, entry barriers exist for new comers. Entry is further less attractive due to the lower marginal costs faced by the incumbents and the revenue generated from multisided markets, through which incumbents are able to offer products at attractive prices.

Nevertheless, it is possible that such offers and discounts may be an initial tactic to gain market control. When the platform becomes a major player, it may charge higher prices for the goods and services or the platform may discontinue the additional offers provided, which may adversely affect the consumer welfare. Additionally, it may also hike the commission rates for sellers registered with the platform. After a point, the sellers may not be able to bargain without having other equally placed platforms with high network effects. Further, the customers are increasingly shifting from offline to online market due to the modern living conditions and convenience.

In this context, the draft E-Commerce Policy issued by the Department for Promotion of Industry and Internal Trade (DPIIT) in February, 2019 also mentioned, ‘with very high network effects, high prices are charged for advertisement. A few social media platforms and search engines control the potential access to customers. Create monopoly and high prices, and entry barriers exists for the new entrants and start-ups to use advertisement’. Existence of big data and network effects enable the top e-commerce firms to sell at a loss.

In India, the e-commerce market is highly concentrated towards the top players. Based on the Statista database, the top five firms in India has a net sales based market share of more than 53 percent in the Indian e-commerce market. We conducted a case study on one of the top e-commerce providers in India using their Annual Reports from 2015 in order to understand how strong is the presence of multisided markets in the Indian e-commerce sector. It is observed that market place service provides them only 69 percent of the revenue generated in 2021. This leading e-commerce firm in India generates more than 28 percent of the revenue from advertisement and marketing. This demonstrate the importance of multi-sided markets in revenue generation. It is also clear that the related party transactions are very strong in this business. Revenue generated from related parties through marketplace services is 23 percent of the total revenue generated by this company. If one includes the marketing and other services provided to the related parties, the revenue share goes up to 36 percent in 2021. This needs to be viewed in conjunction to the proposed draft E-Commerce Policy that, the online platforms should not discriminate the sellers in favour of one or few sellers/traders registered. This is to protect the interest of the domestic business including MSMEs and start-ups for whom it is not possible to have country wide distribution network. In future, we need to look at the specifics of such transactions to see whether they are creating unfavourable conditions to the sellers in the respective sector.

| This blog was written by Beena Sarasawthy for the IGIR and METRO Faculty of Law Maastricht #COMIPinDigiMarkts2022 project - More blogs on Law Blogs Maastricht |

This blog is part of the project #COMIPinDigiMarkts2022. These blogs have been specially prepared by participating internal and external project members and focus on competition law and IP law, with particular reference to the digital markets.

Other blogs:

Also read

-

Digitalization has gradually changed business models and reshaped human lifestyles. The rise of business models based on the collection and processing of consumer data allows undertakings to charge business customers and final consumers different prices for the same goods or services, offered at...

-

The drafters of EU Computer programmes Directive were aware of the competition law implications of extending protection to the interfaces necessary to enable interoperability of programs and devices. Neither the U.S. Congress nor the CONTU seemed to think of interoperability. So the U.S. Copyright...

-

In April 2020, the French competition authority adopted an interim decision against Google obliging it to enter into negotiations with press publishers to establish the amount of remuneration for the use of publications protected by the related right for press publishers, as foreseen by the DSM...