News

-

Get ready for the ultimate European election experience! On April 29th, Studio Europa and Politico are hosting the third edition of the Maastricht Debate, gearing up for the European Parliament elections (6-9 June).

-

In the upcoming months, we’ll share tips on Instagram on how to live a healthier life. Not just a random collection, but tips based on actual research happening at our faculty. The brains behind this idea are Lieve Vonken and Gido Metz, PhD candidates at CAPHRI, the Care and Public Health Research...

-

Interview with Dr Zlatan Mujagic, MUMC+ gastroenterologist and liver physician. An international research consortium, including NUTRIM researcher Zlatan Mujagic, has investigated the effects of stress on the gut.

-

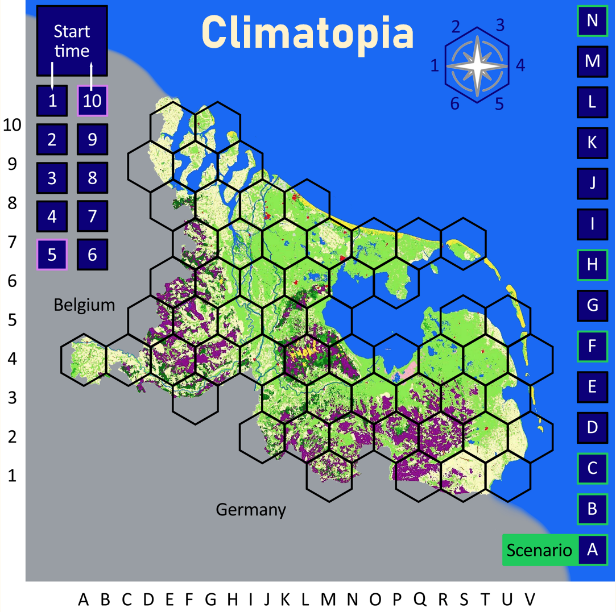

What if students could use play to learn to think strategically, apply economic concepts and deal with complex problems? This is what we have started exploring in the first of a series of three pilots of the Maastricht Immersive Learning Lab.

-

The Globalisation & Law Network organised a roundtable on Circular Economy and Trade, promoting a discussion about circular economy regulations in the European Union and Brazil.

-

The Maastricht University Green Office was the first one in the world and the movement spread out with now 101 Green Offices world wide. In this article, the UM Green Office reflects on how far it has come since its founding in 2010 and what it strives to accomplish in the future. With the recent...

-

How can and should the government respond to the current low participation in the national immunization programme? Can certain forms of coercion be justified? The book Inducing Immunity? Justifying Immunisation Policies in Times of Vaccine Hesitancy provides answers.

-

In its formal report, the committee noted that it was very impressed by the quality and relevance of research at FASoS.

-

On 20 March 2024, the Globalisation & Law Network hosted the seminar featuring Professor Jacob Öberg (University of Southern Denmark).

-

“We have become an obesogenic society” say Anne Roefs and Gijs Goossens in an interview with the Limburger.