Cushioning supply shocks through diversification

In the light of numerous recent disruptive events, the (economic) sustainability of cross-border supply chains receives increasing attention in public debates. Consequences of natural disasters, political power games or an enduring pandemic become widely felt, even when countries are not directly involved. Understanding the interdependencies created by trade in global value chains (GVCs) is subject of ongoing research at the department of Macro-, International and Labor Economics (MILE) and relevant for addressing the challenges faced by governments in different parts of the world. This blog entry presents results of a recent study conducted by Karsten Mau (Assistant Professor of Economics at Maastricht University/SBE) and Jonas Böschemeier (a former BSc student at Maastricht University/SBE, who now follows a research master in Economics at the Tinbergen Institute).

written by Karsten Mau

Assistant Professor of Economics, Department of Macro-, International and Labor Economics (MILE) at the School of Business and Economics, UM

The project investigates the effect of international supply-chain disruptions in the context of the COVID-19 pandemic, by studying how lockdowns in different parts of the world are associated with import volumes in the Netherlands. Being the prototype of a highly developed, small open economy – where numerous business models, firms and jobs are directly or indirectly linked to international trade – the country’s exposure to supply-chain disruptions is important to understand. Indeed, the combined value of goods flowing into or out of the Netherlands during the past years ranged at around 140-150% of its GDP (according to World Bank data). Data from the World Input-Output Database further reveal that more than 55 percent of the value of intermediate inputs used in the production of Dutch non-service industries are sourced from abroad. More than 60 percent of the output of these industries is exported for further processing or consumption.

The persistent, yet uneven, unfolding of the COVID-19 pandemic in the year 2020 constitutes an event that has been disruptive on several layers, including direct and indirect impacts on supply and demand in an economy. This becomes evident from international trade statistics, where the value of imports into the Netherlands in 2020 ranged about 13 percent below what would have been expected based on previous years’ figures. While demand-sided factors certainly contributed to this contraction, the research focuses on supply-sided factors; that is, the part of the contraction that can be attributed to disruptions in foreign countries. Moreover, we attempt to determine which factors or characteristics of products and markets have contributed to mitigating the contractions. Answers to these questions inform ongoing debates on viable strategies in the quest for building resilient economies that strike a balance between economic efficiency and risk-minimization.

Combining customs data with information on COVID19-related lockdowns around the world

The analysis relies on detailed information collected by the Dutch customs and statistical offices on monthly import transactions for a wide range of products and partner countries. We combine this information with the Oxford Coronavirus Government Response Tracker (OxCGT), which monitors countries’ management of the pandemic on a daily basis. Among other information, the OxCGT provides indicators on the strictness of Coronavirus Containment Measures (CCMs), such as school closings, workplace closings, and restrictions on domestic and local mobility (e.g. public transport, stay-at-home regulations or domestic travel). Using this information, we construct a measure describing the evolution of restrictions that inhibit production activity in a country and thereby expected disruptions to its supply capacity.

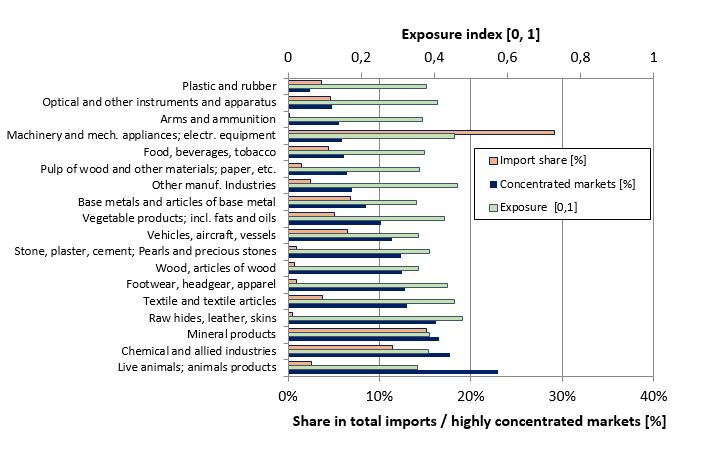

Combining the variation in countries’ CCMs over time with information on their traditional role as suppliers to the Dutch imports market, we find that goods and industries varied in their exposure to foreign lockdowns during the first year of the pandemic. For example, we observe that Machinery and Mechanical Appliances, including Electrical Equipment belonged the most exposed products. They are also economically important as they account for about 30 percent of total goods imports into the Netherlands. Other highly exposed categories are Textile Articles or Raw Hides, Leather and Skins, although they used to account for much lower fractions of total imports before the pandemic (about 3.7 percent or less). Base Metals and Articles Thereof, as well as Transport Equipment range among the least exposed, economically important product groups, while important inputs from the Chemical and Allied industries or Mineral products face intermediate levels of exposure. The patterns are summarized in Figure 1 below.

Empirical analysis and findings

The research employs econometric methods to statistically infer the effect of foreign supply-sided disruptions on the volume of Dutch imports during the first year of the pandemic. The main findings suggest that imports dropped by 8.4% due to lockdown-induced disruptions to foreign supply. This corresponds to about two-thirds of the overall contraction in imports, observed during 2020, and to an absolute amount of approximately 46 billion euros (i.e., 5-6% of its GDP in 2019).

Despite such a considerable impact, the Netherlands enjoy a relatively strong international position that may have helped the country mitigate an even stronger contraction. Being highly integrated in international markets and having a more diversified portfolio of suppliers than many other European economies should enhance its resilience to supply-sided disruptions, due to better substitution possibilities. Our analysis finds support for this hypothesis, as the least concentrated markets revealed significantly smaller contractions (by about 30-45 percent) than the most concentrated ones. Hence, diversification can effectively cushion supply shocks so that globalization and economic integration become part of the solution in the quest for economic resilience.

Next to observing smaller contractions in more diversified import markets, we seek evaluate the importance of substitution effects directly. To do so, we analyze to what extent the bilateral imports from, for example, Poland were affected by lockdowns in another country, say, China. Indeed, if shipments from Poland grow as China’s CCMs tighten, we interpret this as supporting evidence for substitution, which would explain the advantage of having a diversified network of suppliers. Our econometric results suggest indeed that Dutch importers substituted their source countries when facing lockdowns in some locations. Moreover, these effects were found to be larger in initially more diversified markets.

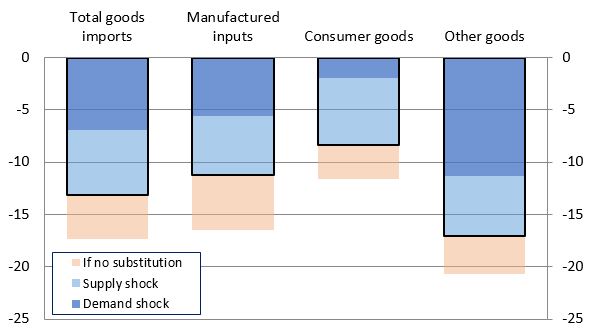

The economic importance of our findings is summarized for different types of products in Figure 2, along with a decomposition of the contraction into its estimated demand and supply side components. For the overall sample, the observed contraction is found to be about equally driven by supply and demand side forces. We find a substantial cushioning effect through trade partner substitution, which is indicated by the areas extending below each bar. Without substitution, the supply shock would have been about 60% larger and led to an aggregate contraction of imports by almost 18% instead of 13%. Also for manufactured inputs, we find economically large substitution effects that may have helped avoid excessive supply-chain disruptions in 2020. For consumer goods, most of the contraction can be attributed to supply-sided disruptions and relatively less substitution can be observed – possibly due to higher ex-ante market concentration that typically prevails when products are highly standardized. Demand shocks dominate in the contraction of imported primary inputs and capital goods (summarized as other goods).

Conclusions

In times of recurring crises and shocks, concerns about excessive external economic dependence receive increasing attention. Such debates surface prominently in the context of “The Supply-Chain Mess”, highlighting their vulnerability to disruptions that propagate into domestic economies. Indeed, such effects can be economically important and concerns should not be seen as limited to international production sharing. In fact, the quest to establish economic resilience and achieve “strategic autonomy”, as EU policy circles frame it, assumes a more general view which includes securing access to basic public services and resources.

The path towards achieving this goal is, however, not clearly mapped out and remains controversial. Absent a sound understanding of the existing interdependencies in contemporary international economic and political relations, vested interest groups successfully called for protectionist policies in recent years. Yet, there is little reason to believe that domestic shocks are generally less likely to occur or harm an economy than external or foreign shocks. In uncertain times where the nature and location of the shock is unknown, our evidence shows that diversification is a reasonable strategy to spread the risk of harmful disruptions by lowering average exposure and facilitating flexible adjustments. Similar conclusions should apply also in the context of the current energy crisis and uncertainty, where the lack of substitution opportunities has become the most evident challenge for stakeholders in all parts of our society.

Photo by Tom Fisk

Figures by Böschemeier and Mau (2022)